Study Abroad Cost Calculator

Calculate Your Total Study Abroad Costs

Estimate your total expenses for studying abroad including tuition, living costs, and hidden fees.

Total Estimated Cost

$0

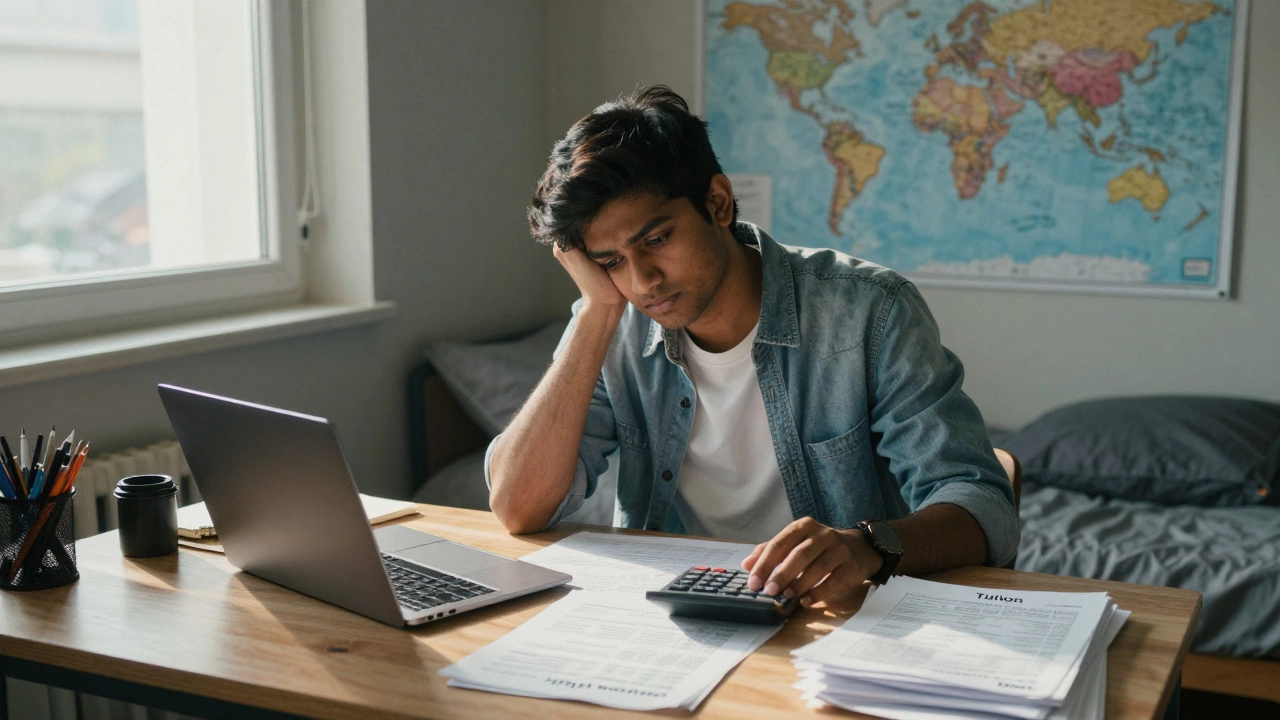

Studying abroad sounds like a dream-new cities, different cultures, degrees that open doors. But then you see the numbers: $40,000 a year? £35,000? And that’s just tuition. What about rent, food, insurance, flights, visas? The real question isn’t whether you can afford it-it’s how much it actually costs to make it work without going broke.

Tuition fees vary wildly by country and course

Tuition is the biggest chunk, but it’s not the same everywhere. In the U.S., private universities charge between $35,000 and $60,000 per year for international students. Public universities are cheaper, but still $25,000-$40,000. Canada? Around CAD 25,000-35,000 ($18,000-25,000 USD). The UK? £22,000-£38,000 ($28,000-48,000 USD), depending on the subject. Medicine and engineering? Higher. Literature and history? Lower.

Then there’s Germany, France, and Norway-countries where public universities charge little to no tuition for international students. Germany charges around €300 per semester in administrative fees. France: €2,770 per year for non-EU students. Norway? Still free, but only if you’re enrolled in a public university. You still need to prove you can cover living costs.

Asia is another story. In Japan, tuition at national universities runs ¥535,800 ($3,500 USD) per year. In Singapore, it’s SGD 25,000-40,000 ($18,500-29,500 USD). Australia? AUD 30,000-45,000 ($20,000-30,000 USD). The pattern? English-speaking countries and elite institutions cost more. Countries with strong public education systems cost less-but often demand proof of funds.

Living expenses aren’t optional-they’re unavoidable

Tuition is just the start. Rent eats up 30-50% of your budget. In London, a single room in student housing costs £800-£1,200 per month. In Manchester or Birmingham? £550-£750. In Berlin? €500-€700. In Tokyo? ¥80,000-¥120,000 ($500-$800 USD). Food adds another £300-£500/month. Groceries, eating out, coffee-those small daily costs add up fast.

Health insurance is mandatory in most countries. In the UK, you pay the Immigration Health Surcharge: £776 per year. In Australia, it’s around AUD 700. In Germany, public health insurance is €110/month. You can’t skip it. No insurance? No visa.

Then there’s transport. A monthly bus pass in Toronto is CAD 120. In Paris, it’s €75. In Seoul, it’s ₩50,000 ($37). Books and supplies? Budget at least $500-$1,000 per year. Some programs require special equipment-lab coats, software licenses, art supplies. Those aren’t included in tuition.

Hidden costs no one tells you about

Visa fees. Application fees. Document translations. Notarization. Airfare. You think you’re budgeting for tuition and rent. Then you get hit with a $1,000 visa fee for the U.S., a $500 biometric appointment in Canada, or a $200 police clearance certificate for Australia. These aren’t optional. They’re gatekeepers.

Orientation programs? Often free. But if you want to join a weekend trip, a language exchange event, or a cultural tour? That’s extra. Student clubs charge dues. Gym memberships? Not covered by student fees. Even printing your thesis can cost $50-$100.

And then there’s currency exchange. If you’re paying tuition in USD but your family sends money in INR or NGN, exchange rates swing. A 5% drop in your home currency’s value means an extra $1,500 out of pocket. Many students don’t plan for that.

How much do you really need? A realistic breakdown

Let’s take a real example: an international student from India studying a three-year bachelor’s in the UK. Here’s what it adds up to:

- Tuition: £22,000/year × 3 = £66,000 ($83,000 USD)

- Living costs (rent, food, transport, utilities): £12,000/year × 3 = £36,000 ($45,000 USD)

- Health insurance (IHS): £776/year × 3 = £2,328 ($2,900 USD)

- Visa and application fees: £1,500 ($1,900 USD)

- Flights (round trip twice): £1,200 ($1,500 USD)

- Books, supplies, personal expenses: £3,000 ($3,750 USD)

Total: £110,028 ($138,050 USD). That’s over $138,000 for three years.

Now compare that to studying in Germany:

- Tuition: €300/semester × 6 = €1,800 ($2,000 USD)

- Living costs: €900/month × 36 = €32,400 ($35,500 USD)

- Health insurance: €110/month × 36 = €3,960 ($4,350 USD)

- Visa and fees: €800 ($900 USD)

- Flights: €1,000 ($1,100 USD)

- Books and supplies: €1,500 ($1,650 USD)

Total: €41,460 ($45,500 USD). That’s less than one-third of the UK cost.

Scholarships and part-time work: do they help?

Scholarships can cut costs-but they’re not guaranteed. Full scholarships for international undergraduates are rare. Most cover 20-50% of tuition. Merit-based scholarships from universities? Competitive. Country-specific ones? Like the Chevening Scholarship in the UK or DAAD in Germany? They exist, but require strong applications and interviews.

Part-time work helps. In the UK, international students can work 20 hours per week during term. Minimum wage is £11.44/hour. That’s £228/week, or £912/month. Not enough to cover rent, but it helps with groceries, transport, and emergencies. In Canada, it’s the same: 20 hours/week. In Australia? 48 hours per fortnight. In the U.S.? Only on-campus jobs, and often limited.

But here’s the catch: working more than allowed risks your visa. And many students find that after 15 hours of classes and 20 hours of work, they’re exhausted. Grades slip. Mental health suffers. It’s a trade-off.

What about returning home? The hidden financial impact

Most students plan to return home after graduation. But that doesn’t mean the financial burden ends. Some countries require you to show proof of funds to leave-like Canada’s departure requirements. Others charge re-entry fees. And if you’ve taken out loans, repayment starts as soon as you graduate-even if you’re not earning yet.

Some students delay repayment for years. Others take jobs in low-paying sectors back home because their degree doesn’t translate. A degree from a top U.S. school might open doors. A degree from a lesser-known university in a non-English country? Might not. The return on investment isn’t always clear.

How to plan without going into debt

Start with a spreadsheet. List every cost: tuition, rent, insurance, flights, visa, books, emergency fund. Don’t guess-use official university websites. Look for student housing portals, local rent listings, and government immigration pages.

Apply to multiple countries. Don’t fixate on one dream school. Compare total costs: tuition + living + visa + insurance. Sometimes the cheapest option is the smartest.

Consider community college or foundation programs. In the U.S., you can start at a community college for $10,000/year, then transfer. In the UK, a foundation year costs £18,000 instead of £25,000 for a full degree. It’s an extra year, but it saves tens of thousands.

And always, always have a backup plan. What if your scholarship falls through? What if your family’s income drops? What if the exchange rate crashes? Build a safety net. Even $5,000 in savings can mean the difference between quitting and continuing.

Final reality check

Studying abroad isn’t a luxury-it’s a major financial commitment. The average total cost for a three-year degree ranges from $45,000 to $150,000, depending on where you go. It’s not about being rich. It’s about being prepared.

If you’re serious about going, don’t just look at the price tag. Look at the full picture: what you’ll pay, what you’ll earn, what you’ll sacrifice. And ask yourself: is this worth it-not just for your resume, but for your wallet, your peace of mind, and your future?

Is studying abroad worth the cost?

It depends. If your chosen degree leads to a high-paying job in your home country or abroad, yes. If you’re studying a field with limited global demand, maybe not. Look at graduate employment rates, average salaries, and visa pathways after graduation. A degree from a top school in Canada or Germany often has better ROI than a mid-tier U.S. school with $100,000 in debt.

Can I study abroad for free?

You can study with near-zero tuition in Germany, Norway, Finland, and France (for non-EU students). But "free" doesn’t mean no cost. You still need to prove you can support yourself-usually €11,208 per year in Germany. Living expenses, insurance, and visas still add up to $15,000-$25,000 per year. True "free" education doesn’t exist-only low-tuition options.

How much money should I have saved before leaving?

At minimum, you need to cover your first year’s tuition and living costs. Most countries require proof of funds for your visa. For the UK, that’s £1,334/month for up to 9 months. For Canada, it’s $10,000 CAD plus tuition. Aim to have 12-18 months of expenses saved before you leave. That gives you breathing room if something goes wrong.

Do scholarships cover living expenses?

Rarely. Most scholarships cover only tuition or partial tuition. A few, like the Fulbright or Chevening, include a living stipend. But those are highly competitive. Don’t count on scholarships to pay for rent, food, or flights. Treat them as a bonus, not a budget.

What’s the cheapest country to study abroad in 2025?

Germany remains one of the cheapest for non-EU students, with tuition under €2,000 total for a bachelor’s. Portugal and Malaysia are also low-cost options. In Malaysia, public universities charge around RM20,000-30,000 ($4,200-6,300 USD) per year for international students. Combined with low living costs, total annual expenses can be under $10,000 USD.

Can I work while studying abroad to pay for everything?

No. Even in countries that allow 20 hours of work per week, you can’t earn enough to cover full tuition and rent. In the UK, working 20 hours/week at minimum wage brings in about £9,000/year. Tuition alone is £22,000. You’ll still need funding from family, savings, or loans. Work helps with survival-not full coverage.